Best Practices for Implementing CRM in Financial Services: A Strategic Guide

In today’s competitive financial services landscape, customer expectations are higher than ever. Clients demand seamless experiences, personalized interactions, and trusted advisory relationships. A well-implemented Customer Relationship Management (CRM) system can help financial institutions meet these demands by centralizing data, streamlining operations, and unlocking actionable insights. However, the success of a CRM initiative depends on more than just technology it requires a clear strategy, alignment with business goals, and adoption across the organization. This guide explores the best practices for implementing CRM in financial services, offering practical steps to maximize client engagement, boost operational efficiency, and drive sustainable growth.

Transforming Financial Institutions with Purpose-Built CRM Solutions

The financial services industry faces unique challenges in customer relationship management, from stringent regulatory compliance requirements to complex client data management needs. We specialize in delivering tailored CRM for financial services that address these specific demands while driving operational efficiency and revenue growth.

By gathering and arranging customer data, A customer relationship management (CRM) system is software that businesses use to monitor and manage their relationships with both existing and potential customers. The capabilities of a CRM platform include boosting efficiency, encouraging business expansion, enhancing contact with current clients, and aiding in lead conversion.

The process of starting a CRM and connecting it with pre-existing system tools is known as CRM installation. This will frequently entail assessing the unique requirements of your organization, setting up and configuring the CRM system, and instructing your workers on its proper use to optimize workflows and support your enterprise.

This comprehensive guide shares proven strategies for successful CRM implementation in banking, capital markets, and investment firms. Whether you're evaluating CRM solutions for investment banking or seeking to optimize your CRM for capital markets, these best practices will help you maximize adoption, ensure compliance, and achieve measurable business results.

Advantages of CRM Implementation

To get the most out of CRM software in your company, you need a plan for its deployment. It offers an organized method that makes sure the technology is used to enhance customer interactions, sales procedures, and general operational efficiency while also coordinating the CRM system with corporate objectives.

A clear plan reduces system implementation risks like process misalignment, data migration problems, and difficulties with user engagement. Businesses may guarantee a more seamless deployment that minimizes downtime and disruptions by giving these factors careful consideration.

A CRM timetable and key performance indicators (KPIs) are established in an implementation strategy to track advancement and evaluate effectiveness. Better customer insights, enhanced communication, and more individualized customer experiences are made possible by this methodical approach, which guarantees that the CRM turns into a useful tool for the marketing, sales, and customer support teams. CRM deployment strengthens decision-making processes based on data-driven insights, increases sales efficiency, and improves client loyalty over time.

Why Financial Services Need Specialized CRM Solutions

The Unique Challenges of Financial CRM

Financial institutions require CRM solutions that:

- Handle sensitive client information with bank-grade security

- Support complex organizational hierarchies and relationship maps

- Integrate with legacy systems and financial technology stacks

- Automate compliance workflows for regulations like MiFID II, FINRA, and GDPR

Our data shows that firms using purpose-built CRM for financial services achieve:

- 35% improvement in client coverage

- 40% faster onboarding processes

- 28% increase in cross-selling success

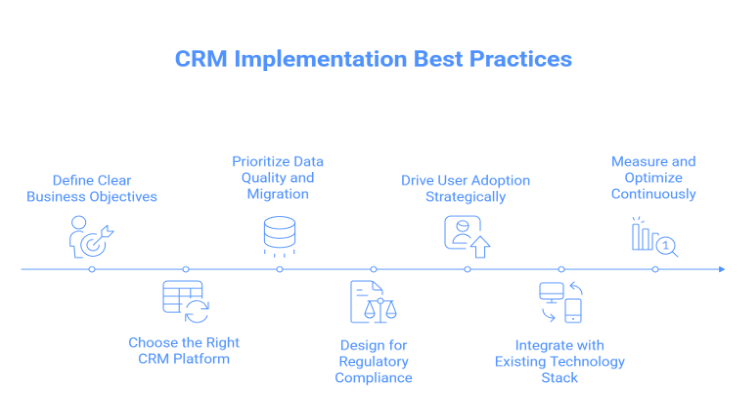

7 Essential Best Practices for CRM Implementation

1. Define Clear Business Objectives

Before selecting CRM solutions, identify your:

- Primary use cases (client management, deal tracking, compliance)

- Key performance indicators (AUM growth, wallet share, touchpoints)

- User personas (relationship managers, research analysts, compliance officers)

Pro Tip: Start with a 90-day pilot focused on 2-3 high-impact workflows.

2. Choose the Right CRM Platform

Look for CRM for capital markets with:

- Industry-specific configurations for financial workflows

- Granular permissioning for information barriers

- Native compliance features like communication archiving

- Pre-built integrations with Bloomberg, FactSet, and other financial systems

3. Prioritize Data Quality and Migration

Effective client data management requires:

- Data cleansing before migration

- Deduplication algorithms for merged entities

- Automated enrichment from trusted sources

- Ongoing data governance policies

Case Study: Using our migration framework, a private bank improved data accuracy by 72%.

4. Design for Regulatory Compliance

Your CRM implementation must address:

- Chinese walls between departments

- Restricted lists management

- Communication surveillance

- Audit trail requirements

Our CRM for financial services includes compliance templates for major regulations.

5. Drive User Adoption Strategically

Overcome resistance with:

- Executive sponsorship from senior leadership

- Role-based training tailored to different user groups

- Gamification of key CRM activities

- Continuous feedback loops for improvement

Result: Firms using our adoption methodology achieve 85 %+ active user rates.

6. Integrate with Existing Technology Stack

Ensure your CRM solutions connect to:

- Portfolio management systems

- Trading platforms

- Research repositories

- Client reporting tools

We offer pre-built connectors for 50+ financial systems.

7. Measure and Optimize Continuously

Track metrics like:

- Client coverage ratios

- Touchpoint frequency

- Deal pipeline velocity

- Compliance audit results

Our analytics dashboards provide real-time performance insights.

Special Considerations by Financial Sector

Investment Banking CRM Requirements

- Deal pipeline management

- League table tracking

- Conflicts checking

- Transaction document management

Asset Management Needs

- Investor relationship mapping

- Capital call tracking

- Mandate compliance

- Performance reporting

Commercial Banking Priorities

- Credit risk integration

- KYC/AML workflows

- Loan pipeline tracking

- Relationship profitability

The Implementation Roadmap

Our proven methodology for CRM implementation:

1. Discovery Phase (2-4 weeks)

- Process mapping

- Data assessment

- Compliance review

2.Configuration Phase (4-6 weeks)

- System customization

- Integration setup

- Security configuration

3. Pilot Phase (6-8 weeks)

- Departmental rollout

- User training

- Feedback collection

4. Enterprise Rollout (8-12 weeks)

- Full deployment

- Advanced training

- Performance benchmarking

Overcoming Common Challenges

Data Silos

Solution: Our CRM for financial services includes:

- Automated data aggregation

- Unified client identifiers

- Cross-system synchronization

Low Adoption

Solution: We provide:

- Customized training programs

- In-app guidance

- Adoption dashboards

Compliance Risks

Solution: Our platform offers:

- Pre-built compliance workflows

- Automated recordkeeping

- Regulatory update alerts

The Future of CRM in Financial Services

Emerging trends we're building into our CRM solutions:

AI-Powered Relationship Intelligence

- Predictive client needs analysis

- Natural language processing for emails

- Automated meeting insights

Blockchain-Enhanced Security

- Immutable audit trails

- Smart contract integration

- Decentralized identity verification

Embedded Financial Technology

- Direct trading capabilities

- Real-time market data integration

- AI-driven research suggestions

Why Choose InsightsCRM?

Our CRM for financial services delivers:

- Industry-Specific Expertise - Knowledge Developed by Financial Experts

- Regulatory-Ready Platform - Compliance features out-of-the-box

- Seamless Integration - Compatible with your current technology stack

- Proven Results - 92% client retention

Quantifiable Benefits:

✅ 30% increase in client-facing time

✅ 45% faster deal execution

✅ 50% reduction in compliance overhead

Getting Started with Your CRM Transformation

Take the first step toward successful CRM implementation:

- Assess Your Needs - Identify pain points and opportunities

- Evaluate Solutions - Compare features and compliance capabilities

- Plan Your Rollout - Develop phased adoption strategy

- Measure Success - Establish KPIs and review cadence

Ready to transform your financial services CRM? Contact InsightsCRM today for a personalized consultation and demo of our award-winning CRM solutions tailored for the financial industry.